Employer-sponsored benefits for financial wellbeing

Financial stress is a huge issue for many

In fact, 67% of all employees report that their finances are the top stressor in their life.* This can lead to distractions at work and dissatisfaction with the company and the employer’s offerings if they’re not helping their employees overcome financial stress.

When employees access financial planning and advice, they feel more confident and empowered in their financial wellbeing. Survey data shows a correlation between employee peace of mind and positive feelings of belonging, job satisfaction, and pride in the company.*

*Source: PwC 2023 Employee Financial Wellness Survey

A Benefit That Impacts Workforce Effectiveness and Performance

Concurrent @WorkSolutions aims to reduce stress and increase the quality of life for your employees. We help you implement benefits that focus on immediate, high-quality financial planning and allaying money concerns. Financially empowered employees build a stronger company culture and work more efficiently — and more profitably. As companies aim to attract and retain top talent and help employees maximize current benefits packages, the Concurrent Corporate Solutions program helps companies like yours provide value and wellbeing to your employees.

Objective, Independent, Client-First

We work with empowered, independent financial advisors to provide unparalleled client service. We focus on helping corporate clients develop and execute strong 401(k) plans and personal financial planning services, bringing a unique level of experience and expertise in employer-sponsored benefits programs. Concurrent is a fiduciary, meaning we act in the best interests of our clients.

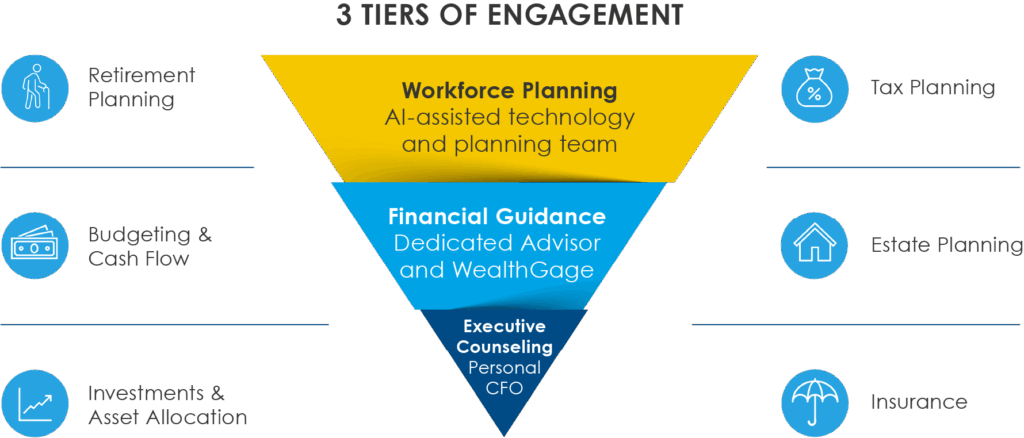

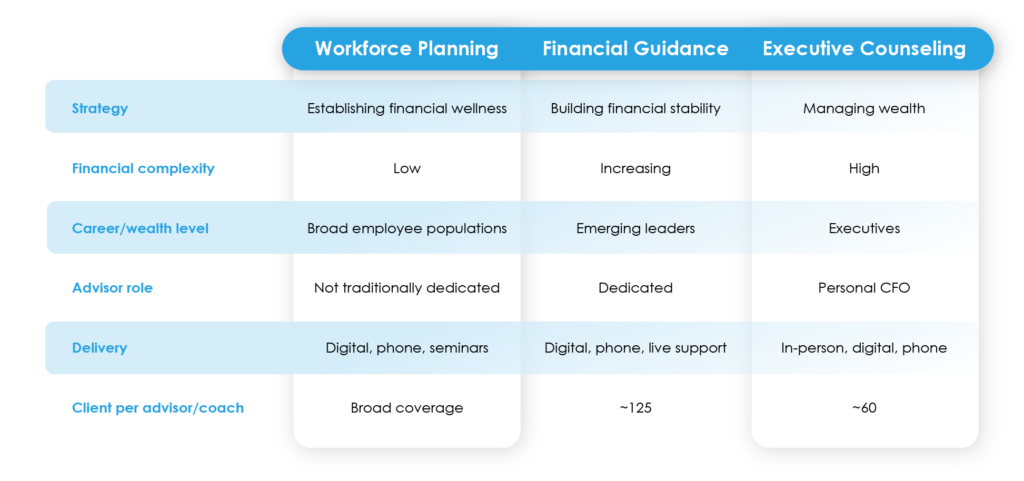

Each tier covers all six financial planning disciplines, delivered uniquely to meet employee needs.

Concurrent Corporate Solutions Planning Tiers

With each level designed to handle progressively complex financial situations, our tiered system can meet the needs of your employees at all levels of the company.

• Workforce planning

Access an AI-assisted technology platform that creates personalized micro-planning journeys. Employees can use a tailored financial platform, team-based planners, and an intelligent, monitored AI assistant to create and implement their own financial plans. This service is integrated directly with employee benefits and payroll.

• Financial guidance

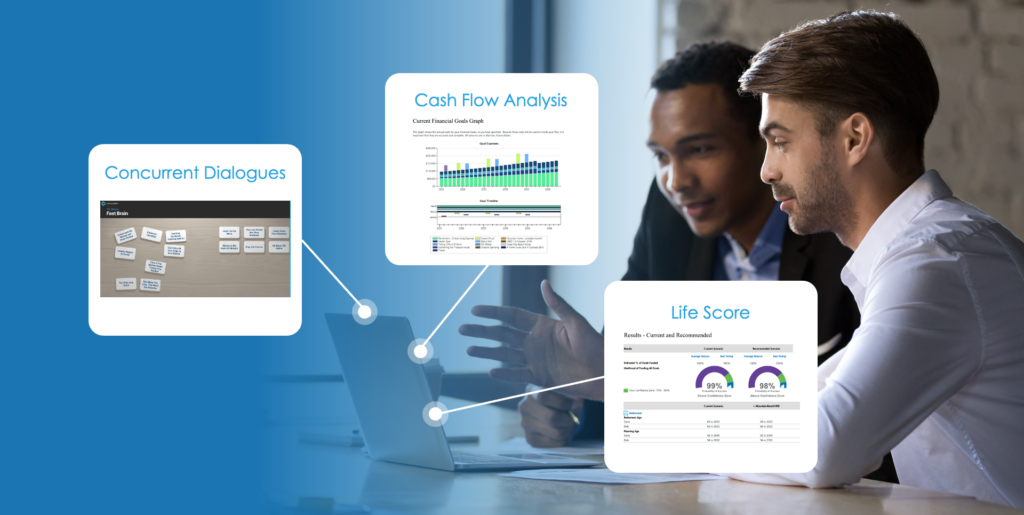

We created WealthGage to help employees gain a strong understanding of their financial goals and priorities. Using behavioral economics and a proprietary tool we call Concurrent Dialogues; we create goals and an aligned financial plan for each person. We work together to ensure the cash flow process and other factors work toward the same goals.

• Executive counseling

This high-touch, personal CFO-like service helps executives manage wealth and complex finances. With a dedicated financial advisor assisted by various subject matter experts, WealthGage allows us to support every financial need that executives face.

- Equity ownership, options schedules, and bonus strategies

- Investment analysis and portfolio implementation proposal

- Tax strategy, tax-loss harvesting, and estate plan structure

- Risk management review and advanced insurance strategies

- Progressive cash flow and distribution planning

Take Your Benefits to the Next Level

Let’s talk about how Concurrent @WorkSolutions can elevate your benefits and improve your employees’ financial wellbeing. Reach out to learn more about our pricing structure and tiered offerings.