US stocks barely moved on Wednesday as Federal Reserve officials left interest rates unchanged and Chair Jerome Powell warned that meaningful inflation could come in the months ahead.

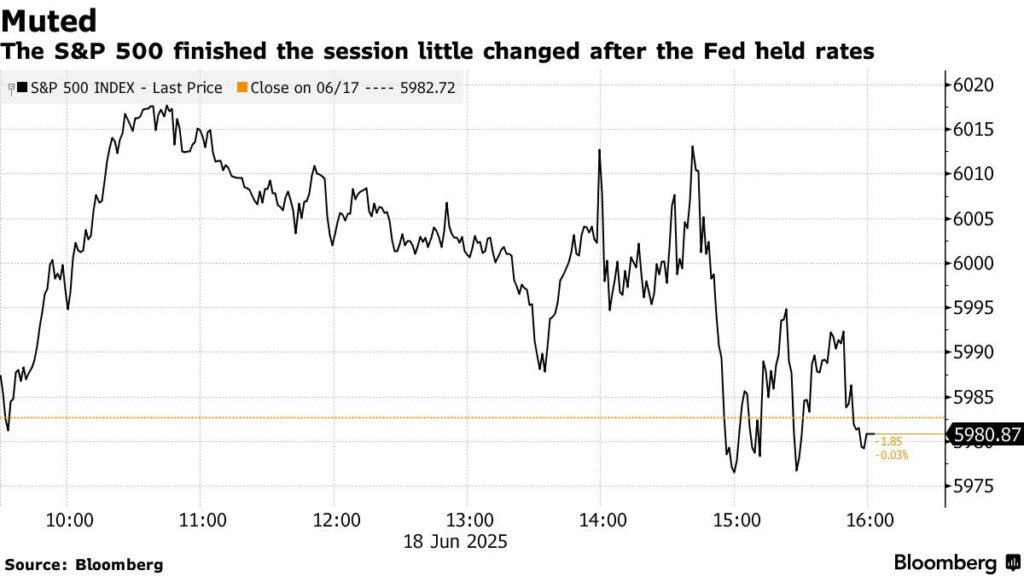

The S&P 500 Index finished the session little changed in New York, spending the latter part of the session struggling for direction. The tech-heavy Nasdaq 100 Index was also nearly flat. The VIX Index hovered around 20.

The Federal Open Market Committee unanimously voted to hold the benchmark federal funds rate in a range of 4.25%–4.5%, as they have at each of their meetings this year. Officials also downgraded estimates for economic growth in 2025, while lifting forecasts for unemployment and inflation.

Following the decision, Powell repeated his view that the central bank was “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

“The Fed is leaving options on the table in regards to their expectations on how tariffs will impact inflation and economic growth in the coming quarters,” said Matt Stucky of Northwestern Mutual Wealth Management.

“With the labor market’s continued resilience, the central bank is in no rush to move on policy with the uncertainty that still remains on where tariffs and their resulting macroeconomic impacts will settle out,” Stucky added.

Two Camps

The projections “reveal two camps on the FOMC,” according to Ryan Swift of BCA Research, noting that seven participants expect no cuts this year while eight see 50 basis points of easing.

The former is “placing greater emphasis on the risk that tariffs spur a sustained increase in inflation starting within the next couple months,” Swift said. The latter, meanwhile, is “more in the Chris Waller camp that views the price impact from tariffs as transitory.”

Investors have also kept an eye on the conflict between Israel and Iran, which continued for a sixth-straight day. President Donald Trump said he would hold another meeting to discuss the hostilities in the Middle East but remained coy about whether the US planned to join Israel’s offensive aimed at destroying Iran’s nuclear enrichment program.

“It’s hard to reasonably predict what the Fed will do in future meetings until we see what implications arise from the conflict in the Middle East and from the resolution in the tariff decisions,” said Leah Bennett, Chief Investment Strategist at Concurrent Asset Management. “The equity market is too optimistic about a muted outcome from these events.”

Meanwhile, data showed applications for US unemployment benefits ticked down last week, stabilizing near the highest levels in eight months. Initial claims matched the median forecast in a Bloomberg survey of economists.

“It is unclear to what degree recent weakness in retail sales and continuing unemployment claims are a reaction to the tariff and geopolitical noise or an indication of an inflection in the strength of the consumer,” said Mark Hackett of Nationwide. “Regardless, headwinds and tailwinds are roughly in balance, setting the stage for an extended period of directionless volatility.”

New US residential construction dropped in May to the slowest pace since the onset of the pandemic, according to government figures, as a combination of elevated inventory and high interest rates sapped the motivation to build.

Among individual stocks:

- Marvell Technology Inc. shares gained after the chipmaker held an event focused on artificial intelligence.

- Boeing Co. shares fell after US safety investigators called for urgent actions in response to an engine issue on 737 Max aircraft that can lead to smoke in the cockpit or cabin.

Read the original article on Bloomberg.